Dear Reader,

I’m worried…

Now we are out of the EU, I’m worried that millions of people believe we’re ‘in the clear’.

Sadly – I don’t think that’s the case.

Yes, Brexit means we are no longer handcuffed to the trading bloc across the channel. Nor ruled by it.

For the first time in decades, our political destiny is back in our own hands.

But what a lot of people do not understand is that we are still tied, in a potentially very damaging way, to the EU’s financial system.

A system that could have a fatal flaw.

In my view, this fatal flaw is something that every saver, homeowner and investor in Britain should know about – and prepare against.

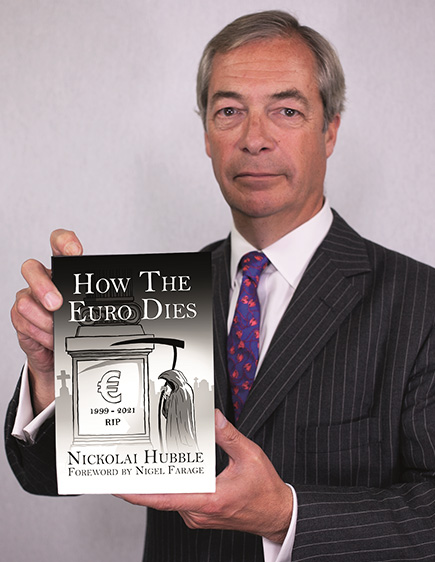

Which is why I’d like to rush you a hardback copy of this book, How The Euro Dies.

It’s written by Nickolai Hubble – a top analyst, whom I trust and work with closely. A man who has spent the last decade showing ordinary investors what’s really going on inside the financial system…

A lot of what is going on now, the trouble behind the scenes, is exactly what he predicted.

And if he is right about what happens next – you need to be prepared.

It is critical you read his book, as soon as you can.

You see, I strongly agree with Nickolai’s analysis.

So much so, I have written a new introduction to his book. And I want to put a complimentary copy in your hands today…

If you have a UK postcode, it’s yours. And it will hit your doormat in the next 7-14 days.

Read the book – weigh the facts – and you will see why I think every saver, homeowner and investor in Britain should have a copy.

Here’s what one reviewer had to say:

“This book is a MUST READ to understand how the EU project will fall apart and why this is inevitable.” (Keith Porter)

Another reviewer summed up exactly why reading this book could prove so important:

Such reactions highlight why I am taking these steps to rush it out NOW.

Most British investors are completely unaware of this impending problem facing the euro – and totally unprepared for it.

If you have money in the market right now…

Own your own home…

Or are building your nest-egg for retirement…

You need to read this book.

Because…

When it comes to the EU’s financial system – ‘Brexit never happened’

Yes, on January 31st 2020, we left the EU.

Something I’d campaigned for, over 27 long years.

And now the transition period that was in place is over too. (It ended on 31 December 2020).

So you’d be forgiven for thinking my work is done.

Sadly, How The Euro Dies shows it isn’t.

You see, while Britain may have severed the political connections between Westminster and Europe… our financial connections to Europe still go very deep.

According to Nickolai, it is those links – those unseen connections – that may pose a threat.

In fact, if Nickolai is correct in the book, he says we could see a situation….

- Four times worse than Lehman Brothers

- Ten times worse than Greece

- And 30,000 times worse than the Asian financial crisis of 1997

Can you see now why I think it is urgent you read it?

As one reviewer put it:

If you suspect that the EU’s monetary system is a time-bomb waiting to explode…

If you think that – although we’re free of the EU politically – we’re still tied-in financially…

If that worries you… you should read this book.

But it is also a timeless lesson in the threats posed by a failing currency…and what it could mean for the international banking system.

As the last financial crisis showed, that is something that everyone should be informed about.

So, if you want some good ideas on how you could come out on the right side of it all if it plays out as Nickolai forecasts…

Please tell me where to send your hardback copy of

How The Euro Dies right away…

The timing could not be better.

Just look at how the EU is dealing with Covid.

As the FT has reported, the bloc is on a losing streak:

“It was slow to order vaccines, slow to approve them and quick to blame a producer when supplies were delayed.”

Individual countries are seeking their own solutions, agreeing deals with Russia and China to make up a shortfall in the number of doses required.

The solidarity of the European Union is under great strain.

And as Nickolai’s book shows – these divisions and imbalances are deeply embedded… and are coming to the boil.

I won’t delve too deep into the details here – I don’t want to do Nickolai’s book an injustice.

(And Nickolai explains all the factors far better than I).

But the simple version is this:

He has identified a fundamental flaw hiding inside Europe’s financial machinery… like a bit of ‘bad code’ in a computer programme that may one day trigger a serious ‘system failure’…

And the flaw means such an event could become a global problem, instantly spreading across the continent, like a virus, to the UK, too.

For many years I have been warning about how the mismanagement of the EU’s economic affairs could lead to disaster…

- In October of 2008 I stood up in Parliament and warned that the financial crisis was getting worse – and was shifting into a sovereign debt crisis in Europe

This was a full two years before Greece went bust.

- In 2012, I even stood up inside the European Parliament and predicted that the deep flaws in the EU financial system would lead to ‘mass unrest’

Time and time again… I took a stand, and warned against the economic problems in Europe.

As the Greek riots in 2015 and the French “gilets jaunes” protests of 2018 showed… so far, in those cases I’ve been proven correct.

But what is to come – if the thesis of this book is correct – could see an even more dramatic and damaging period unfold.

If Nickolai is right, worse than the 2008 meltdown. Worse than the 2010 European Sovereign Debt Crisis.

No matter how you voted in the referendum… no matter what your political beliefs… you should get an understanding of this situation, urgently. It’s all in Nickolai’s book.

Claim your complimentary copy. Read it closely.

You’ll be well aware that I dedicated the best years of my life to separate our political fate from that of the EU…

But, as I explain in my foreword to the book, it was the euro and its potential economic consequences that got me into politics in the first place.

How it’s imbedded financial flaws could cause a big blow up, sooner or later…

One that may have an impact for ALL UK investors, savers and homeowners.

Because the impact of a potential EU financial failure won’t care how you voted.

And it will treat everyone who is unprepared the same.

“I campaigned for 27 years to get Britain out of the EU…”

Which, again, is why I want you to claim your own hardback copy of How The Euro Dies.

When you receive your copy, open it, take the time to read it and you will discover how history shows the ‘bad penny’ at the heart of the eurozone project was, perhaps, always doomed…

And the four factors that could see it reach a point of no return:

- The unholy trinity: an economic law that exposes the fatal flaw of the euro

- The ultimate north-south divide: and its potentially catastrophic debt ‘deathlock’

- The people say NO: how democracy could play its part as voters turn against the failing euro project

- Funds denied: why the rescue package is already all used up

As I said, if you give me a ‘yes’ today, we’ll make sure your copy hits your doormat in the next 7-14 days.

Now, you might be wondering…

Who is Nickolai Hubble – and why should you listen to his warning about the death of the euro?

Nickolai Hubble – the man who predicted the 2018 Italian banking crisis

Well, for a start, Nickolai is my colleague at Fortune & Freedom.

He’s whip-smart. Degrees in finance and law.

But he also has first-hand experience of crashes and crises. He cut his teeth with an internship at Goldman Sachs and witnessed the financial crisis of 2008 from the inside.

Thanks to his time at Goldman Sachs, Nickolai saw what the financial services industry was really like, behind the scenes. As he puts it, “at their worst.”

As a result, he went on to work for independent publishers that allow their analysts to predict the kinds of financial crises that some investment bankers cause.

It’s something he’s very good at.

Nickolai has been helping readers for years to get wise on enduring assets like gold and silver, as well as new asset classes like bitcoin and the wider crypto market.

He believes, as I do, British investors need to take back control of their financial lives. He doesn’t just pay lip service to that idea, like so many others – Nickolai has shared practical ideas with his tens of thousands of readers about how to actually make it happen.

And he has a nose for understanding how things pan out…

In 2012 Nickolai exposed the sub-prime practices of Australian banks to his readers at The Money for Life Letter. His accusations that bankers and mortgage brokers routinely manipulate their customers’ loan applications were later vindicated by a Royal Commission in 2018.

In 2018, he predicted a big blow up in the Italian banking system. Just a few months later, that’s exactly what happened – and Nickolai had successfully warned his subscribers about the worst period in financial markets since 2008.

In 2019 he was predicting how British shares could boom after Brexit – something very much born out at the start of this year. (Take this headline from sharesmagazine.com: “FTSE on track for stellar first week of 2021”).

In January 2020, he was warning of China’s treatment of the Uighurs and how it would raise concerns about doing business with President Xi Jinping’s Communist Party.

And in June last year, he explained to his readers how to look to profit from potential negative interest rates in the UK - something that is currently high on the topical agenda.

So, I give considerable weight when he says:.

Nickolai argues there is only one way they can get that.

And his argument will not make him popular with the bureaucrats in Brussels.

They are not open to criticism – I know from experience!

They will not want to hear that their pet project was always flawed… that its disorderly bust-up is inevitable…that an EU-wide economic recovery necessarily hinges on the euro’s demise.

In fact, I have witnessed those ‘eyes wide shut’ first hand…

I remember a dinner with former French President Valéry Giscard d’Estaing at the Spectator magazine offices in 2016. Former BBC broadcaster Andrew Neil raised some pertinent questions about the euro, only to be met with the iciest of responses. No questions are allowed and all criticisms are heresy.

If he is right about the bigger problems inside the EU financial system, as I firmly believe he is, we could see widescale financial turmoil.

In a situation like that, it’s hard to predict the precise ramifications. And I’m not here to make any forecasts or to speculate. No-one can really say how events on such a scale may play out. But it IS a scenario you need to, at the very least, understand.

I simply want you to see facts no-one else is showing you about problems no-one else wants to talk about.

Because, if Nickolai is right, those that prepare in advance stand the best chance of riding out any turmoil…

And, potentially, coming out on the right side of it.

“Read it and read it now”

I think it is essential that every UK saver, homeowner and investor reads this book

I urge you to secure your copy of his easy-to-read book, How The Euro Dies.

As I said earlier, I have arranged a way for you to get a complimentary hardback edition sent to your home address – no financial commitment necessary.

My publishers here at Southbank Investment Research have agreed to provide a limited print run of new hardback copies… but with over 120,000 people likely to see this invitation, you’ll need to move decisively to secure your copy.

You already know that I think this book is essential reading – especially if you have money in the markets and are serious about growing your nest-egg through thick and thin.

But now I’d like you to hear from those who have already secured a copy. Here’s what readers of Nickolai’s book wrote in to say about it:

Those readers are already informed about the inherent flaw imbedded with the euro as Nickolai sees it… I think you should be too. Right now, rest assured. I have one copy reserved for you.

So, please don’t delay because…

You need to come out on the right side of all this

You can’t afford to get this wrong.

If or when this potential Euro crisis comes to pass… Nickolai points to some financial shocks that he believes will reverberate around the globe.

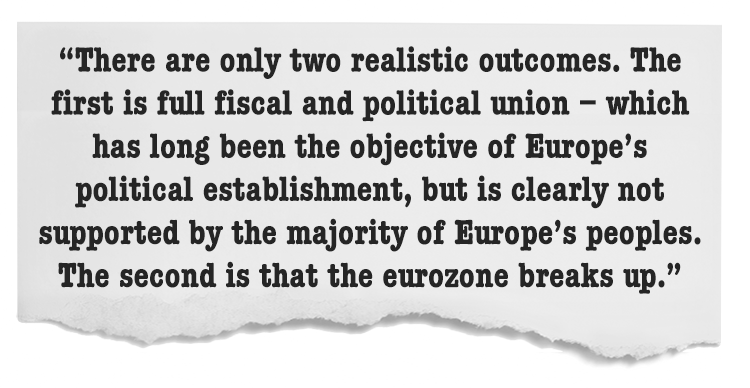

To quote from Nickolai’s book (page 18 and 19 to be precise):

Nickolai may be right or he may be wrong.

But it is important that you are be aware of it.

And while it’s impossible to say if this happens next Thursday… next month… or next year…

Nickolai puts it like this:

His compelling book will show you why and how this could happen.

Nickolai expertly lays out what is at stake.

He explains simply and clearly how it could unfold. He’s not trying to feign certainty – but he does want to show you what may be in store.

And by the time you’ve finished his book, you will understand how Britain CANNOT completely avoid this crisis - if it hits.

The interconnected financial system is like a vast and complicated web. And if one thread snaps, the vibrations will be felt everywhere.

As you’ll learn in chapter 10, in 2020 Britain’s banks lent more money to financial corporations than to non-financial corporations .

By lending to financial institutions instead of businesses…

Nickolai says we are exposed to the unstable nature of banking systems twice over. So a blow up in the EU’s banking system would likely not be good news for UK savers.

However, Nickolai also believes – and I agree with him - that individual British investors CAN avoid it.

This is a crucially important point.

So, let me spell it out one more time:

Britain cannot avoid the worst of this potential crisis.

But I believe individual British investors – like YOU – can.

Though, please be warned: it requires something on your part. Taking steps now to prepare for the death of the euro – as laid out in Nickolai’s book -- could really pay off..

To some extent, I think most people understand we may be long overdue a financial correction of some sort.

The markets seem ‘toppy’, don’t they?

The central banks of the world have moved heaven and earth to keep the markets afloat. Trillions have been pumped into world markets over the last decade.

But how long can they delay what seems like the inevitable?

There is a disconnection between high flying stocks and economic reality, especially coming out of a pandemic that has triggered high unemployment and the closure of so many businesses.

And that means some people have taken measures to hedge their bets a little.

They may even have pulled their money out of what they believe to be the most at risk assets.

But today I want you to understand – the crisis Nickolai is predicting may require specific and swift action on the part of savers and investors.

The first thing you need to do is understand what could happen.

Claim your copy of How The Euro Dies and you’ll know what could be coming.

Of course, that then begs the question:

What to do next?

As I say, understanding the problem is only the first step.

What steps you should take after that…

Steps to protect, preserve and to potentially grow your wealth – whatever the markets and the world throws at you – are harder to decide.

Which is where I want to help you.

Because the decisions you do make with your money now, in this challenging time, could have a lasting impact on your financial life for years to come.

With that in mind, Nickolai has prepared a special report – a mini survival guide if you like - of moves you can make when a crisis hits… and I will make sure you receive a FREE copy which will be sent to your inbox simply for reading this letter today.

It should hit your inbox within the hour...

And you will discover 8 ways you could potientially profit in the event of a stockmarket collapse.

What’s more. I have used my connections within the financial world to help stack the odds back in your favour ahead of such an event too…

To do that I have called in one of the top investors I know…

A master investor who has spent the last decade of his life sharing his best opportunities with ordinary people… showing do-it-yourself investors how to bank profits like 178%, 59% and 52% (to name but a few).

Past performance is not a reliable indicator of future results.

I have called on him to help in this uncertain time.

A time in which the euro is coming under increasing pressure from within its own system…

And the financial authorities are injecting more cheap money into the markets in the hope of supercharging economic growth.

The Bank of England has even talked about banks and building societies needing to prepare for the possibility of negative interest rates.

Were that to happen – and there is no guarantee that it will – you and I could be penalised for holding cash in our savings accounts.

Charged for saving money! Isn’t saving for a rainy day – especially now – a good idea?

But forget for a moment the possible threat of negative interest rates…

Perhaps more worrying – and just as dangerous to your potential pension pot – is inflation.

After decades of supressed inflation, most investors are not well prepped for it to surge.

For example, bonds – which have been low-risk for years – tend to suffer when inflation takes off. Bonds make up a big part of many people’s pension pots.

There are many more unseen and little talked about consequences of an inflation surge.

The reality is, most people will just sit there and take it. They do not have the information and direction they need to keep their portfolios above water. Their purchasing power drops. Which means money buys you less and less. It’s a dim prospect.

So where do you go next?

If you’re being penalised for saving, where do you invest wisely?

In the face of all these challenges… the brewing euro crisis… potential negative rates… the fallout from the pandemic… inflation…

Where do you turn?

Who has your best financial interests at heart?

Who can you trust to see clearly through all the distractions and noise?

This is where I believe we can help…

Meet my man “from the inside”

Rob has deep experience showing investors how to make the most of their money

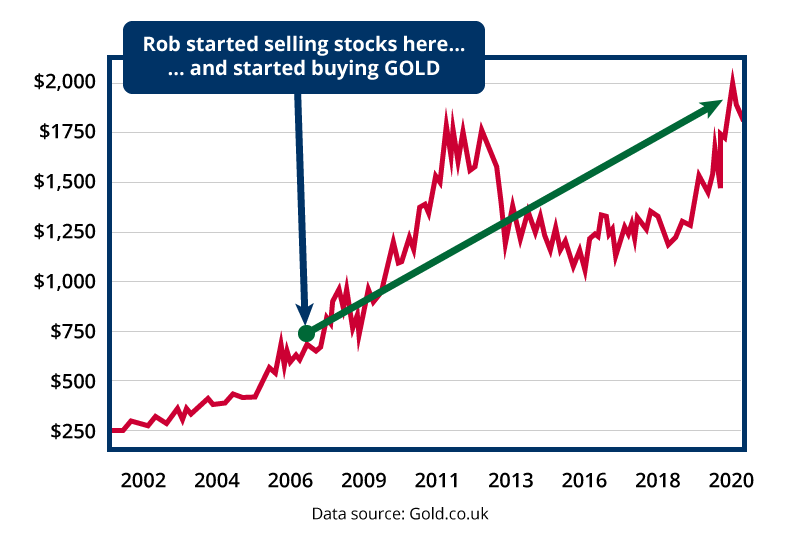

For 15 years, Rob Marstrand travelled the world working for Swiss banking giant UBS… heading up multi-million pound deals in almost every corner on the planet.

He’s got an eye for opportunity, and for spotting big blow ups in the market.

He managed to get OUT of the banking system right before the 2008 crash – selling all of his banking shares and options, cashing in his stock portfolio and moving into gold.

Past performance is not a reliable indicator of future results.

5 year performance of gold: 2015: -11.59%, 2016: 8.63%, 2017: 12.57%, 2018: -1.15%, 2019: 18.83%, 2020: 24.43%

He even managed to warn his local housing association to get their savings deposits out of the Icelandic banking system – right before its big crisis back in 2008...

After that, he became the Chief Strategist for one of the world’s best-known “financial entrepreneurs”… a man with three New York Times best-sellers to his name… and founder of multi-million pound businesses in seven different countries worldwide.

In that role he showed private, ambitious people how to make more from the financial markets than they likely ever thought possible.

Now he is working alongside Nickolai and myself to help British investors like you take back control of your money... starting with a simple wealth building blueprint we have put together on your behalf, immediately.

Along with your complimentary copy of Nickolai’s book (and his special ‘survival guide’ report), this blueprint gives you a valuable ‘protect and profit’ strategy:

Rob’s 3 simple steps to wealth…

There are three specific things Rob believes every smart British investor should be doing with their money today – to help them preserve it and potentially grow it, come what may.

In the light of what we have already talked about, I agree with each and every one of them.

Step #1: Protect what you’ve got

No one has ever become truly wealthy – and I mean real, lasting wealth – by being reckless.

Yes, there’s a time and a place to be bold.

But your first move should always be protect what you’ve got.

Never more so, right now.

As The Independent recently reported, the UK economy in 2020 was the worst it has been since the ‘great frost’ of 1709” – with output falling 9.9%...”more than in any year since comparable records began ”.

The problem is, with interest rates on savings at extraordinary lows and the European banking system creaking… that’s harder to do today than at perhaps any time in history.

So what are your options?

You could look to the less risky, less volatile assets.

If those assets pay you a regular income, so much the better.

Rob thinks that many areas of the market are cheap, overlooked and pay an income.

And that’s why he’s laid everything you need to know – and do – out in a simple-to-follow briefing…

I’ll give you more details on how to get hold of it in a moment.

But first let’s look at Rob’s second step…

Step #2: Buy the “Best of Britain”

When historians write about Britain leaving the EU… that historic moment will come at the start of the story. The rest will be taken up by what comes next.

We have our political, economic and social freedom…

Now it’s up to us – no one else – to make the most of it.

And while it’s not 100% clear how we’ll use that freedom yet – thanks mostly to our friends in Westminster…

It IS clear there will be winners and losers from Brexit.

Rob believes claiming a stake in the WINNERS could well be the best way to share in the freedom that Brexit creates.

I agree.

And that’s why targeting the “Best of British’ companies is the second pillar of our strategy.

The good news is, Rob has laid out exactly which British stocks he’s watching right now for you…

Again, I’ll tell you how to get your hands on it in a moment.

After I’ve outlined Rob’s final step…

Step #3: Take advantage of “special situation” opportunities

It’s a famous investment quote: “Buy when there’s blood in the streets”…

And it is credited to Baron Rothschild who, appropriately enough, made a mint buying in the panic that followed the victorious Battle of Waterloo against Napoleon.

2020 gave us a great example of just how profitable a crisis can be – IF you understand what’s really going on quickly enough…

The Covid-19 pandemic has sent many businesses under. Millions worldwide have lost their jobs. In Britain, almost two million people are unemployed. Another 11.2 million have been “furloughed”. In the US, a record 20.5 million people lost their jobs last April.

Yet the price of gold has soared… rising more than 45% over the last two years, but has since declined in more recent months.

Are we in for a repeat of the 1930s? Nobody can predict that.

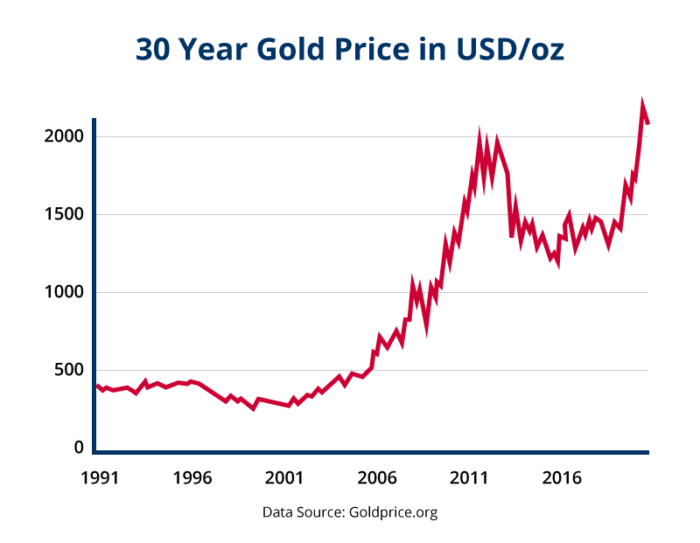

Gold is valuable. It’s endured over thousands of years. And over the last two decades, holding some of the ‘precious yellow stuff’ would have been a very smart idea indeed, as the graph below shows.

Past performance is not a reliable indicator of future results.

5 year performance of gold: 2015: -11.59%, 2016: 8.63%, 2017: 12.57%, 2018: -1.15%, 2019: 18.83%, 2020: 24.43%

Forecasts are not reliable indicators of future results.

Some respected analysts suggest gold could rise to $5,000. Even higher.

Which is why Rob will run you through everything you need to know… including the type of physical gold he believes could offer you maximum possible upside, why the taxman won’t get his hands on any profit you see and… how to store your physical gold, the smart way.

That’s three steps you can take now: protect what you’ve got, look to the best of Britain and ‘special opportunities’.

Rob has put all this information into three specially prepared reports…

The complete Wealth Building Blueprint you can see here…

What’s more, these three reports can be in your hands the moment you claim your hardback copy of How The Euro Dies.

They’re yours to read and use to help better your financial future.

All I ask in return is that you try out my new publication…

A new monthly letter to help UK investors like yourself take back control of their financial lives.

Introducing…

UK Independent Wealth is a new communication from myself and Rob Marstrand…

If Nickolai Hubble’s book is your way to identify the biggest future risk and threat you might face as an investor…

Consider UK Independent Wealth as your monthly guide to the opportunities on offer, their strengths and weaknesses…

A way for you to receive our research on the financial markets on a regular basis…

Revealing how the geopolitical shake-ups we’re seeing impact you and your money…

With specific investment recommendations from Rob – showing you how to play these seismic events to your advantage.

But it offers more than financial recommendations.

It’s a private intelligence service – cutting through the noise and nonsense, showing you what really matters. What you really need to know to get a leg up with your money.

I want to show you that it IS possible for you to take back control of your money…

It is possible for you to make your own decisions, with confidence.

And it is possible to do all of that without having to fork out performance fees to ‘the industry’.

Whatever the markets throw at you – the brewing euro crisis included – there are opportunities for you to grow your money.

I know that if you have made the effort to read this today, then you have a sincere desire to improve your financial situation.

I am not going to stand in your way.

This new movement – my ambition to create a wealth revival for someone just like you – is too important.

You will risk nothing to simply try it out. Just see if it is for you. Just to see for yourself if our publication chimes with your outlook on the world…

And your personal financial ambitions.

It would be stupid of me to say our new publication can replace your broker or IFA or pension provider, that isn’t the point.

My ambition in UK Independent Wealth is – with Rob’s help – to show you that you can be a smarter investor… to share alternative ideas the mainstream industry probably won’t show you… to share intelligence from within the system…

All of which will help you make your own, more informed decisions. If you have a financial adviser, or a broker you trust… stick with them if you want.

But why not get a little something extra?

Why not have an alternative in your back pocket… to receive regular opportunities off of the mainstream radar?

I want everyone with the burning desire to grow their wealth to be able to read it. And use it.

Not just this year. Or next year. But for many years to come…

Nearly 5,000 investors have joined us up so far…

I want to help people do better with their money, not be cowed by a fear mongering media.

Month after month, you will be receiving ideas, investment recommendations, and strategies… to help you grow your wealth, deal with the challenges we’re facing now, and those to come

We’ll be showing you ways to protect what you have… potentially draw in some much-needed extra income… and buy into opportunities Rob thinks are trading below their true value.

You’ll get updates on the market developments that impact your money.

And you’ll hear from special guests of ours, experts imbedded within the financial system… who can give you a true picture of what’s happening ‘behind the scenes’.

This is a new project. We opened our doors in December. Already, we are approaching 5,000 subscribers… people who share one powerful ambition: to be the masters of their own financial destiny.

The response has been overwhelming, and I have been receiving many emails, just like the ones below:

I hope that all sounds great to you..

Because, as I say, you can gain unrestricted access to this new publication for three whole months, without any financial commitment.

The second you accept my offer – which you can do in just a few moments’ time – you’ll instantly unlock a huge amount of wealth building benefits…

Join UK Independent Wealth today and receive your complimentary copy of How The Euro Dies…

The potential for a euro collapse is a story that should be front and centre of any serious news agenda…

And Nickolai’s not the only person telling it.

Professor David Blake, Professor of Economics at City, University of London told the Daily Express at the start of this year:

Before you start Step #1 – protecting what you’ve got. You need to know what you could be up against.

In 12 easy-to-read chapters, Nickolai’s eye-opening book lays out the longer-term investing landscape and what he see’s as the possibility of the largest financial crisis Europe has ever seen.

How important is it that you read your copy sooner, rather than later… take it from those who already have the book in their hands:

Not only will you get your copy, you’ll also receive:

My exclusive sit-down discussion with the book’s author Nickolai Hubble…

In this interview, recorded exclusively to help you understand the severity of this brewing problem, I talk to Nickolai about his thinking behind the book… and why I was so keen to write its forward.

You’ll learn why I also always believed the euro was doomed – in fact, it’s why I moved from the City into politics in the first place.

You’ll also hear how healthy debate on the issue has always been frowned on.

The book and the interview are just for starters.

I know your ambitions for your money are high. As they should be. So I am aiming to match those ambitions with the material you receive when you take up a no-obligation trial to my service, UK Independent Wealth.

So, I have prepared something special for every new member.

You’ll also get unrestricted access to the three investment reports from Rob, I just told you about.

They contain prudent moves to make as part of his ‘protect and profit’ wealth building blueprint…

Starting with:

Yours TODAY: The REIT Move: How to collect “rent” without the headaches of being a landlord

Owning property appeals to everyone.

Rob has found a way for you to enjoy the main benefit of owning property – collecting a nice income – without the drawbacks of being a landlord, dodgy tenants, maintenance bills, property taxes and with overcharging agents.

It’s called a Real Estate Investment Trust (or REIT, for short). It’s traded like a stock. That means you can sell it reasonably quickly, unlike physical property which can take many months. They also offer you, on average, more stability than stocks – as there is an underlying “real” asset backing the investment.

The main benefit is the yield, or “rent” you collect, being exposed to the rental income from properties worth many millions of pounds. Plus the investment itself offers you growth, and can appreciate in price, just like a stock.

There are risks of course, as there are in every single investment you make. Property prices rise and fall, which can impact REIT income and growth. The government might change the tax rules. Or the management team might underperform. Every move on the markets carries risks you need to consider and REITs are no different.

To save yourself any sleepless nights, simply follow the golden rule – only invest what you can afford to lose if things don’t go your way.

Everything you need to know is in this report which you will be able to download and read as you await the arrival of your copy of How The Euro Dies.

You will also receive your guide on how to buy the ‘best of British’:

Yours TODAY: “Three prime British stocks for the top of your watchlist”

Like me, Rob believes there’s big potential for certain British companies to thrive after Brexit. And like me, he believes in being prudent – letting some of the current market mayhem settle a bit before he gives you the green light.

You want to get into these opportunities at the best price – and Rob believes it’s worth the wait.

To get you ready for that moment, Rob has prepared a special report to share his expert analysis on his top targets.

Read his case for these choice British companies. See why he believes they’re worth keeping on your radar. Understand the risks in play for each and see why Rob thinks its important to wait to pull the trigger. You’ll have time to make your own decision.

Rob will get you up to speed on:

Forecasts are not reliable indicators of future results.

- The world leading firm with a track record of great growth and dividend payouts.

- The UK pub chain with huge bounce-back potential when lockdowns end.

- The innovative online estate agent that could thrive from pent up demand.

Everything you need to know about these three companies is in Rob’s easy-to-read report “Three prime British stocks for the top of your watchlist”.

And the third pillar of our strategy…

Yours TODAY: “Hard money: The best way to own gold”

As a former precious metals’ trader, I can tell you, I’ve never seen a better case for gold as an investment.

But what should you buy to take advantage of the gold boom?

How should you buy it?

And how much of your portfolio does it make sense to allot to gold?

In his expert briefing “Hard money: The best way to own gold” Rob shares his deep experiences as a gold investor.

Claim your UK Independent Wealth trial subscription and also get your hardback copy of How The Euro Dies today. You will be able to download these three reports instantly.

These three reports alone set you up to follow the core tenets of UK Independent Wealth. Capital growth, savvy long-term investing and generating extra income.

You’ll also unlock a series of bonuses that I believe can only strengthen your hand against the coming storm, including:

Exclusive video: Q&A with Rob Marstrand

I like the way Rob thinks. I respect his years of experience showing private investors how to make the most of their money. And I admire his prudence when it comes to making investment recommendations.

But I want you to get to know Rob better, and trust him.

So I asked Rob to sit down in the studio and answer some key questions so you can see just how deep his experience goes.

You’ll learn about his knack for spotting approaching financial disasters… some of the most rewarding opportunities he’s shared with ambitious investors, over recent years… and you’ll hear the important lessons he’s learned when it comes to taking charge of your own financial affairs.

On top that, in case you are just starting out as an investor, I’d like to also give you:

FREE bonus report: The Road to Financial Freedom

This is a step-by-step guide to investing in the stock market. You’ll learn:

- How to open a brokerage account

- How to use dividends to boost your income

- How to place a trade

- Setting stops and buy limits to reduce risk

- The ins and outs of stamp duty and capital gains tax

You’ll also hear from three ‘masters of the markets’ on the most important lessons they have learned over the years.

Not only will Rob share his own personal lessons with you…

We also asked gold market expert and $600m family wealth manager Eoin Treacy…and renowned growth stock investor. Sam Volkering to share their wisdom, too. That’s more than 60 years’ worth of market know-how, at your fingertips. Any ambitious investor has a lot to gain from this exclusive briefing.

And you’ll receive a video on how to choose a broker that is right for you.

I think that gets you off to a running start…

But even THAT isn’t everything you get, when you become a no-obligation, trial member of UK Independent Wealth.

7 excellent reasons to start right now…

Let me walk you through seven reasons I believe you should sign up and start immediately:

UK Independent Wealth Member

Benefit #1:

12 wealth-growing ideas every year

Every single month Rob and I will write to you with your issue of UK Independent Wealth. We’ll share our latest thinking on the biggest issues facing British investors – whether that’s a threat to your money… or a big opportunity you could capitalise on.

It will keep you fully informed of the issues we’ve already talked about…from the state of the markets to the pressures building across the channel.

Every issue will contain at least one idea from Rob you can use to grow your wealth.

That might be a UK stock with real moneymaking potential. It might be a new addition to our “Tea Chest” portfolio. Or it might just be something we think stands a good chance of making you better off.

In short, if you want to try and grow your wealth and look to get richer every year… your monthly issue of UK Independent Wealth is unmissable.

Benefit #2:

Zero guesswork investing – Rob will give you full buy, sell and hold advice

When Rob recommends a stock or fund he’ll give you specific “buy up to” prices – so you know exactly what he sees as too much to pay for any given stock.

Once he’s made a recommendation it’ll enter one of our model portfolios. We’ll be with you every step of the way. We’ll then keep track of it. We’ll keep you up to date on anything you need to know about it. In fact, Rob and I discuss every selection that is made in a special video that you, as a member, will have exclusive access to.

And when Rob thinks it’s time to take profits or cut losses we’ll be in touch to tell you what to do.

If something important happens in the markets and we think you need to know about it, we’ll be in touch. You’ll never be left wondering about how the model portfolio is impacted.

The financial world moves fast and we’ll keep you up to speed… just as Nickolai did in 2018 when he predicted Italy’s budget battles would lead to “Bloody October” and successfully warned his subscribers about the worst period in financial markets since 2008. As he describes in How The Euro Dies, these were the tremors of the earthquake still to come.

Benefit #3:

Take control of your own money – with expert guidance

Investing your money in any financial market carries risk.

Let’s be grown up about that. Risk is nothing to be feared. But you DO need to understand it.

Most mistakes people make in the financial world happen when they take risks they don’t understand. They invest too much money. Or maybe they don’t know quite what they’re doing.

We won’t let that happen to you. We’ll give you a full write-up of the risks involved in any position. If something is listed abroad, we’ll explain the foreign exchange risks. If it’s an exchange traded fund, we’ll explain what that is and what the risks to the underlying investment are.

We are going to be ambitious, on your behalf, but that doesn’t mean taking on huge risks.

Rob will be seeking and researching investments he believes are seriously undervalued… offering you a chance to grow your stake substantially.

And he’ll be investing his own money in his recommendations as far as he is allowed. He will have “skin in the game”.

As I said, the idea isn’t to replace any investing you do now… or any guidance you already

receive, and trust… UK Independent Wealth can run alongside all of that, giving you a different perspective and valuable extra intelligence and exposure to new opportunities.

Benefit #4:

Independent thinking – and honest analysis

I’ve operated inside the political and financial establishment ever since I was 18.

In that time, I’ve built up one of the best network of contacts’ in the world - from world leaders to major players in the financial world, on the phone.

Believe me, this gives you a hell of a better insight on what’s really happening in the world.

And now you’ll be able to take advantage of this “insider insight” too – because I’ll share it with you.

Does that mean we’ll get every big call right? No. Of course not!

But I promise we’ll do a hell of a lot better than relying on the mainstream financial press would.

But, as you will see in your urgent investment reports, Rob will provide his full investment case for everything he recommends… all the potential rewards will be explained… as will the different types of risks associated with investing in different assets like stocks, REITs, physical metals or ETFs. You’ll get the whole picture, in plain English.

Benefit #5:

A personal login to our private, members only website

Everything I just told you about is hosted securely online on a subscribers’ only website.

I’ll make sure you get your own login and password to access this site anytime, 365 days a year.

You’ll be able to browse all your valuable reports, at your leisure.

Watch any videos we record. Review the online model portfolios.

And, of course, read every issue of UK Independent Wealth as we go along.

Benefit #6:

Online Q&A videos with me and Rob

Every quarter, Rob and I will sit down on camera to answer your most pressing questions.

We can’t give you personal financial advice. But we CAN answer your big picture questions on the state of the economy… of the political situation… and on Brexit.

Put simply, if something big is going on and you want to understand it – we’ll do our best to explain it in simple, no nonsense language.

Benefit #7:

Take 90 days to try everything out

I think you’ll love everything you see when you become a subscriber to UK Independent Wealth.

In fact, I think you’ll want to stick with us for a long time. (That’s certainly my goal. Building real wealth takes time. And the problems I’ve outlined for you today won’t go away overnight.)

But I want it to be your decision to stick with us.

But I want it to be your decision to stick with us.

So – here’s what I’m doing. I’m offering you the next 90 days to review everything I just told you about.

Take a look at our analysis… Rob’s stock picks… your valuable reports… and everything else you get.

If you don’t like what you see – you can cancel and walk away with a full refund any time in your first 90 days.

No ifs. No buts. No hidden small print.

It’s an iron clad 90-day money back guarantee. And it puts you in the driving seat. It means you only stay on as a subscriber if YOU choose to.

So how much will you pay if you decide to stick around long term?

Not a lot.

In fact, considering you’ll be getting hundreds of pounds worth of investment intelligence the moment you join us…

I think you will consider it an absolute bargain.

Certainly, when you consider “the competition”.

The average HOURLY rate for an IFA in the UK is £150.

According to the website Unbiased, most people pay £500-£5,000 a year for advice.

And that’s if they’re not paying a chunk of their profits over to their money manager.

The whole industry is fraught with small print… confusing fees… and the sense you’re not quite getting good value for money. Of course an IFA knows your personal financial position so the service is specifically tailored to you.

I want to go another route.

To repeat: UK Independent Wealth can’t give you personal advice.

But Rob CAN share what he considers the very best wealth building ideas and stock picks in the country.

Ideas that are timely, often alternative.

One year of UK Independent Wealth costs just £199 a year.

That works out at around 50p a day.

That’s it.

No hidden fees. No cut of your profits. Just a flat rate subscription.

Why such good value?

Well, I don’t want price to stand in anyone’s way. And I know that the best outcome for both of us is for you to become a long-term subscriber of ours.

My hope here is that you will make UK Independent Wealth part of your regular reading.

And I want you to review everything we have produced for you under no pressure whatsoever.

That’s why I’m giving you the next 90 days to trial the publication out under an iron clad money back guarantee.

If you don’t like it, just get in touch and get your money back in full.

I think that’s a good deal. It’s one that I’d want, if I were in your shoes.

And it’s why we’re charging a low, flat annual fee that’s easy to understand and affordable for everyone.

But it gets even better…

Because you can actually secure your first year for a lot LESS than £199.

In fact, if you click on this button right now you can secure your first year for as little as £79.(You can review your order before it's final)

Decision time – are you with me?

I know my new project will have some people up in arms. There are plenty of people out there who think that all your money should be controlled and managed by someone else.

And they may say that Nickolai’s book is just hot air.

But it is your money, isn’t it?

No-one cares about your money as much as you do.

So, shouldn’t you know all the facts?

After all, the challenges you are facing are REAL.

The fallout from the pandemic.

The spectre of negative interest rates.

And, of course, the potential crisis of the Euro and the problems it could cause the entire financial system. All the details are covered in Nickolai’s book.

My aim is to help you keep your money growing – and to use these changes and events to your financial advantage.

UK Independent Wealth is my crusade to empower you to understand more about your money…it is all about you being in control. Not the government, not the financial industry, not Brussels.

And I believe – with Rob’s recommendations and Nickolai’s book in your hands – we can help you do just that.

Particularly with the big changes in the world we are seeing.

Some will fall on the right side of these historical changes. Others will be left behind.

This is not the time to have someone else taking all the risks with your investment capital.

Instead, it’s time to take back control.

Become the hero of your own financial future.

That’s my goal here. To help you succeed.

That’s why I’ve written to you today.

It’s why I first offered you the chance to secure your copy of what I think is essential reading for any investor looking beyond covid and what 2021 has in store.

It is why I am inviting you to try out UK Independent Wealth.

It’s why I’ve explained what’s happening in the world today… shown you how it could impact your money…

…and shown you how Rob’s wealth building blueprint could help you come out on the right side of it.

But now it’s over to you.

JOIN NOW

- Receive your hardback copy of How The Euro Dies

- My one-on-one interview with the author, Nickolai Hubble

- Nickolai’s ‘survival guide’

- Rob Marstrand’s wealth blueprint: your 3 investment reports

- Your first issue of UK Independent Wealth

- Bonus report: The Road to Financial Freedom

- And much more

It’s decision time.

It’s not the ballot box I’m asking you to make a choice at…

It’s right here, right now.

And your financial future is – I believe – at stake.

Because the fight isn’t over.

Yes, we all know about the threat to our economy – and the world’s in general – thanks to the coronavirus pandemic.

You can hear about that on the nightly news.

What you hear less about is how what’s happening today and tomorrow is potentially making an existing threat – hidden in plain sight – much, much worse.

You need to know how the euro crisis could play out and what it could trigger… before you can fully appreciate the opportunities (as well as the dangers) that might bring.

Should the euro project turn out to be the biggest single – and most predictable – failure in global financial history… the European banking system surely cannot escape some form of collapse…and this will be followed by deep economic turmoil.

If that’s not worth preparing for…

And if by preparing you for it, we can help protect you from it – and even prosper as Britain potentially booms…

I don’t know what is.

Which is why I hope you will join me, Nickolai and Rob here at UK Independent Wealth.

CLICK HERE to claim your copy of Nickolai’s book – and start your 90-day no-obligation trial(You can review your order before it’s final)

Many thanks for your time today,

Nigel Farage

Founder, UK Independent Wealth

March, 2021

PS. I thought you’d like to hear a little more from Nickolai Hubble himself…

So, we sat down with the author of How The Euro Dies and asked him 5 key questions that you might want answers to:

Why did you write How The Euro Dies?

What surprised you most when researching the book?

What could be the cost of ignoring this threat?

What do you want people to take away from the book?

Why have you arranged, with Nigel, for people to get a complimentary copy of the book?

PPS. From what I see, too, the industry has been addressing some of the problems like the ones I just shared with you.

I’m certain that even many of the professionals, some of whom may have underperformed, often have your interests at heart. When you invest at all, you have to accept that you can’t win every time.

So, I don’t want you to turn your back on them, by any means.

I want to make that crystal clear.

Talk to them. Listen to them. Use your judgement and see if they can help you. Especially if you are a novice investor.

But something MUST be missing here. When I asked my readers about their bad experiences, I received hundreds more letters like these… from people who feel like just a number. I’m simply sharing those messages with you.

For a lot of people, something clearly isn’t working – is it?

It looks like too many hardworking men and women are being poorly served by some of the professionals out there.

Because when I receive messages like this one, I really do worry about what’s going on:

Enough is enough!

Let’s take back control of our money

No-one has taken up the challenge for you. No-one has taken up the fight for the financial life you have earned… and deserve.

Not the politicians grandstanding in Parliament.

Not the celebrities on social media, too busy backing the latest fad cause.

And not the mainstream financial media who are overwhelmingly cynical about new or alternative financial ideas.

But I will.

And I am!

I’ve never told anyone what to do or what to think.

But I have fought hard for your right to have a choice.

That is what Brexit was all about. Giving you the choice to determine your future.

But the new frontline for your independence is not in politics…

It is in the financial markets.

That is where it all, finally, counts.

To paraphrase Margaret Thatcher – “how can you be free if you’re not financially free?”

I am going on a personal crusade to empower you – and anyone else who sincerely desires a life of real financial liberty.

We have nothing to fear by taking matters into our own hands.

You do not need to cede complete control to strangers.

As I said, there is value in hearing what the professionals have to say. Let them share their plans. Let them give you ideas.

But they are not your only option.

You do not have to take their word as gospel.

In fact, there is a movement, a groundswell, of people starting to take charge… take back control of their money themselves.

People who want to become heroes of their own stories when it comes to their money.

People who embody the fierce independent streak that has rung through our proud history.